祝贺任慧勇同学顺利通过博士论文答辩 | DBA捷报

发布时间:2021-01-14 11:51

业精于勤,行成于思。2021年1月14日,企业家学者项目首二班同学、中电产融控股公司董事长、大唐金融控股集团董事长任慧勇迎来了他的毕业论文答辩时刻。他围绕主题《论中国现阶段混合所有制产权改革激励机制对公司业绩的影响》进行了深入分析,现场的精彩阐述让人印象深刻,最终顺利通过答辩。恭喜任慧勇同学!让我们一起回顾他的答辩风采。

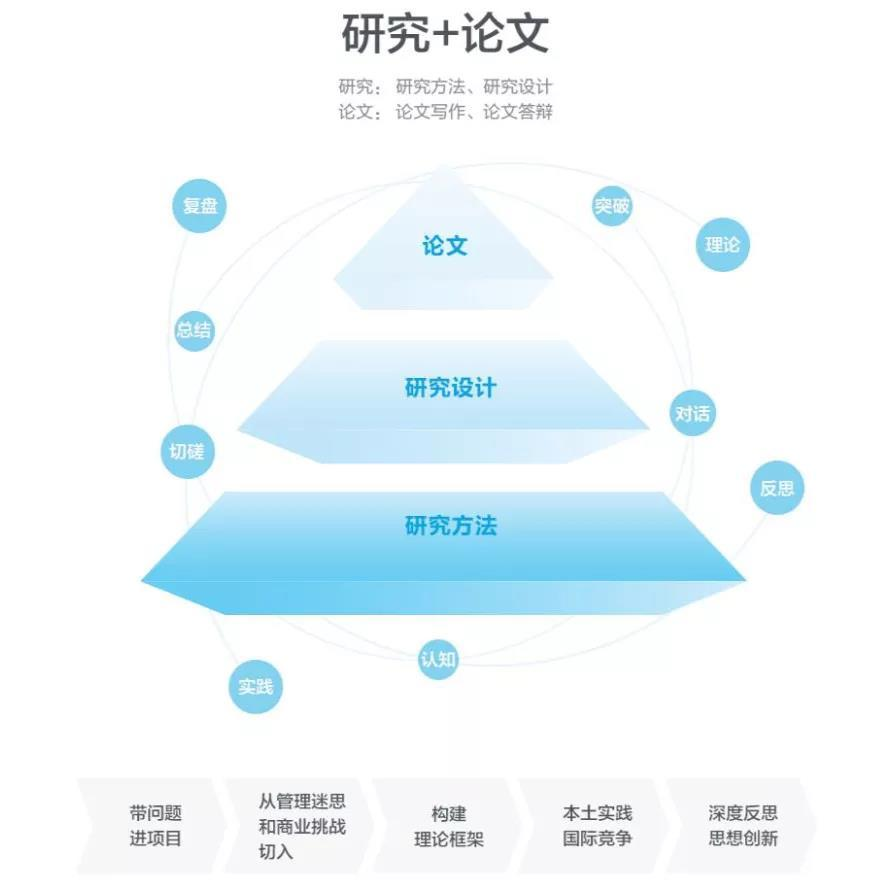

长江商学院企业家学者项目以成就新商业文明思想者和引领者为愿景,整合全球优质教育资源,打造极具前沿性和系统性课程,在行业内引领、在细分领域独树一帜的精英群体提供持续系统的终身学习平台,实现“理解-判断-实践-引领”的跨越式发展,任慧勇同学在系统、深刻的框架思考和跨界思维的学习中,洞察行业大势与规律,站在商业、信息、理念、观点、方法的最前沿,共同迎接新商业文明的机遇与挑战,不断地提高拓进、蜕变成长、不忘初心、探索真知。

本次论文答辩,来自长江商学院和新加坡管理大学(SMU)的教授们共同见证了任慧勇同学的学术成果。

任慧勇 | 论中国现阶段混合所有制产权改革激励机制对公司业绩的影响

任慧勇同学答辩中

▇ 论文摘要:

自2017年年初,中央经济工作会议将混合所有制改革定调为国企改革突破口以来,从央企到地方国有企业,都在不断推出涉及混合制改革的新举措、新部署。混合所有制改革(以下简称“混改”)将民企灵活的市场应对机制和创新的管理体制引入到国企内,来提升国企的市场意识,增加自身竞争力、活力及创新力,从而为企业打造一个符合现代化企业治理的体系,能更从容地应对市场的变化。当前,国企混改已取得了初步成效,混改企业数量逐渐增多,但仍有不少企业处于观望状态,真正完成混改的企业并不多。此外,虽然政府部门已经公布了混合所有制改革的顶层设计方案,然而并没有现成的操作体系可以借鉴,所以有必要从实践案例出发对企业混改进行相关研究,探索混改的可操作路径,为其他混改企业提供借鉴作用。

混合所有制改革是一项涉及产权制度的深度改革,其落脚点不仅停留在对所有权结构的改变上,还着眼于体制机制改革。在混改过程中,企业依据不同的市场和治理目标,选择不同的混改路径,设计不同的激励机制,进而对企业绩效产生影响,革新后的激励机制配置是企业改革能否取得预期成效的关键。基于此,本文重点关注的问题是国有企业混合所有制改革背景下企业激励机制革新与企业绩效的关系,以混改企业的激励机制为研究目标,选取云南白药和绿地集团为具体分析案例,从企业内外部环境出发,逐步分析它们的混改动因与路径,具体分析案例企业在混改背景下,激励机制调整与企业绩效的关系,最后提出当前国企混改实践中激励机制存在的问题以及改进建议。

本文在产权理论、委托代理理论和激励理论的基础上,通过对高管经理人需求、人性假设与行为分析构建出激励的基本理论框架,对当前国有企业混合所有制改革实践中面临的问题对激励要素的影响进行了重点结构剖析,并对激励体系进行了实证检验与案例分析。在核心要素分析上,本文以最优薪酬体系为切入点,选择薪酬激励、股权激励、精神激励等要点对照分析,同时从“一层三会”治理结构、党组织监督的惩戒机制、市场化经理人选聘等结合中国特色的管理制度作为补充和保障,试图构建一个混合产权改革背景下完善的激励体系,并能够实际应用。

答辩现场

通过研究,本文得出如下结论:第一,増资扩股是国有企业混合所有制改革新的突破口。通过增量模式对国有企业推动混合所有制改革,有助于扩充企业资本(做大)、増强企业活力(做强),尤其是有力地促进国有企业位于混合所有制发展期间的治理效率,形成的共赢局面。第二,股权激励已成为公司绩效的普遍激励模式。在股权虚拟模式激励下,高管经理人享受一定数量的分红和股价升值收益权,但不稀释国有控股地位对股权结构不产生影响。同时,即时的收益权会对经理人形成有效激励,继而影响当期的企业利润。第三,民企身份转换是有效的转岗通道,比国企任留更能促进激励。国有企业混合所有制改革所需的高管转岗通道包括由行政任命的原国有企业经营管理者通过任留身份转化而来、通过市场化选聘的方式获取外部职业经理人、民营企业家身份的转化。第四,构建事业合伙人分享机制比绩效分配更能有效实现激励。国有企业混合所有制改革必须在人才管理方面进行创新,重新界定经理人与企业的关系,将员工看作企业的“人力资本合伙人”,打破原有的雇佣关系,将管理者转变为企业的所有者,职业经理人转变为主人翁,让员工分享企业发展所带来的财富。

本文的创新点在于从公司治理的角度采用多案例研究国有企业混合所有制改革问题。目前国内大多数文献是从单一的股权层面或单一案例层面的改革路径进行论述,成系统的针对激励机制的分析较少。本文作者将观点由点串成线,再扩展为面,全面而清晰的分析研究中国国有企业混合所有制改革会面临的阻碍,并提出适用的解决方法,为国企混改搭建合理的路径。由此,本文主要有两方面的贡献:在理论方面,探究了产权改革对企业绩效提升的内在机理,从产权改革的激励机制角度研究企业绩效提升机制,丰富激励机制的多维理论研究。通过对中国混改模式的委托代理体系进行剖析,将其与产权改革的激励机制衔接,推演产权改革对企业绩效提升的内在机理,研究产权改革的激励机制和企业绩效提升的关系,运用解构分析的方法探寻企业绩效提升的关键机制。在实践方面,本研究一方面为国有企业混合所有制改革路径提供理论指导,另一方面,为国有企业混合所有制改革政策制定提供案例参考。

答辩现场

▇ ABSTRACT:

Since the Central Economic Work Conference set the mixed ownership reform as where China’s state-owned enterprises (SOE) can make breakthroughs on reforms in early 2017, enterprises at all levels, from central to local state-owned, have continuously introduced new measures and new deployments involving the reform. The mixed ownership reform (hereinafter referred to as the "mixed reform") introduces flexible market response mechanisms and innovative management systems from private enterprises into state-owned enterprises to enhance the market awareness of state-owned enterprises, to increase their own competitiveness, vitality and creativity. It aims to build a system that conforms to modern corporate governance and better responds to market changes. At present, the mixed reform of state-owned enterprises has achieved initial results. In spite of a gradual increase in the number of enterprises, quite a few are still in a wait-and-see situation. Only a few have actually completed the mixed reform. In addition, although government departments have announced the top-level design plan for the mixed ownership reform, there is no ready-made operating system to borrow experience from. Therefore, it is necessary to conduct research on the mixed-ownership reform from practical cases and explore its feasible paths to provide reference for other enterprises.

The mixed ownership reform is a comprehensive reform involving property rights, rooted in not only changes to the ownership structure, but also system and mechanism revolutions. In the course of reform, enterprises take different paths and design various incentive mechanisms to suit different markets and governance objectives, which in turn will have an impact on corporate performance. The configuration of incentive mechanisms after the reform comes as the key to assessing whether the reform achieves expected results. On this basis, the paper focuses on the relationship between innovating incentive mechanisms and enterprise performance in the context of the mixed ownership reform of state-owned enterprises and sets the goal of research at incentive mechanisms for mixed-reform enterprises. In the case study of Yunnan Baiyao and Greenland Holdings Corp., Ltd., the paper starts with the internal and external environment of enterprises to analyze the causes and paths of their mixed reforms, examines the relationship between incentive mechanism adjustments and corporate performance in the two companies, reveals the problems existing in incentive mechanisms in the course of practicing the reform, and puts forward suggestions for improvement.

任慧勇同学在企业家学者项目

On the basis of the property rights theory, the principal-agent theory and the incentive mechanism theory, the author builds the basic theoretical and practical framework for incentives through analyzing the needs of senior managers, human nature assumptions and behaviors, expounds the impact of the problems occurring in the current mixed ownership reform of state-owned enterprises on incentive elements, and carries out empirical examination and case analysis of incentive mechanisms. For the analysis of core elements, this paper sees the optimal salary system as an entry point and compares such key points as salary incentives, equity incentives, and spiritual incentives. It also tries to construct a complete and practice-oriented incentive system against the background of the mixed property rights reform, supplemented by management systems with Chinese characteristics, including the governance structure of "three meetings and one layer", the disciplinary mechanism of party organization supervision, and the market-oriented recruitment of managers.

Our work has led us to four conclusions as follows. Firstly, increasing capital and shares should be a new breakthrough in the mixed ownership reform of state-owned enterprises, by which corporate capital can be expanded (to make a larger company) and corporate vitality strengthened (to make a stronger company). In particular, it can effectively promote the governance efficiency of state-owned enterprises during the mixed ownership and formulate a win-win situation. Secondly, equity incentives have become a common model to drive company performance. Under the incentive model of virtual equity, senior managers can enjoy certain dividends and the rights of share price appreciation without weakening the state-owned holding status or impairing the equity structure. Meanwhile, immediate right to earnings will work as an effective incentive for managers and in turn affect current corporate profits. Thirdly, status conversion to private enterprises is an effective channel for job transfer and a more appealing incentive than retention in state-owned enterprises. The channels for executive transfer for the mixed ownership reform of state-owned enterprises include the tenure transfer of former state-owned enterprise managers appointed by administration, the market-based recruitment and hiring of external professional managers, and the identity transfer of private entrepreneurs. Fourthly, building a business partner sharing mechanism is a more productive incentive than performance distribution. The mixed ownership reform of state-owned enterprises must bring creative changes to talent management, redefine the relationship between managers and enterprises, treat employees as the “partners of human capital” to break away from the original employment relationship, and turn the management into the owner of an enterprise and professional managers into the masters, thus enabling employees to share the wealth brought by corporate development.

任慧勇同学在企业家学者项目

The highlight of this paper rests on the study of problems related to the mixed ownership reform of state-owned enterprises from the perspective of corporate governance through multiple cases. At present, most domestic literature discusses the reform paths from the level of a single equity or case. Few researchers have addressed incentive mechanisms in a systematic way. In the course of analysis, the author fans out from point to area, analyzes the obstacles to the mixed ownership reform of China’s state-owned enterprises in a comprehensive, clear pattern, and proposes applicable solutions to paint a reasonable roadmap for the reform. Therefore, the value of our contribution lies in two aspects. In terms of theory, it explores the internal mechanism that explains how the property rights reform contributes to corporate performance from the angle of incentive mechanisms and enriches multi-dimensional theoretical research on incentive mechanisms. Supported by the analysis of the principal-agent system in the mixed ownership reform, this paper connects the system with the incentive mechanism of the property rights reform, deduces the internal mechanism of the property rights reform that works on corporate performance improvement, studies the relationship between incentive mechanisms and the improvement of corporate performance, and investigates the key mechanism that enhances corporate performance via deconstruction analysis. With respect to practice, our research aims to provide state-owned enterprises with theoretical guidance on the paths of the mixed ownership reform and offer insights into the formulation of policies for the mixed reform.

合影

<范昕宇教授(右二)代表许成钢教授参加了本次现场答辩>

论文答辩圆满结束,但对于任慧勇同学来说,这是一个新的开始。作为一名新商业文明的先行者和探索者,在自己的工作实践中亲身体验,并在企业家学者项目的课程学习中洗礼蜕变,带着探索的热情与勇气一步步走来,最终顺利通过答辩,相信在今后的日子里,任慧勇同学的灼见与智慧,将会对整个行业的发展不断推进助力。