祝贺孙伊萍同学顺利通过博士论文答辩 | DBA捷报

发布时间:2023-11-30 18:53

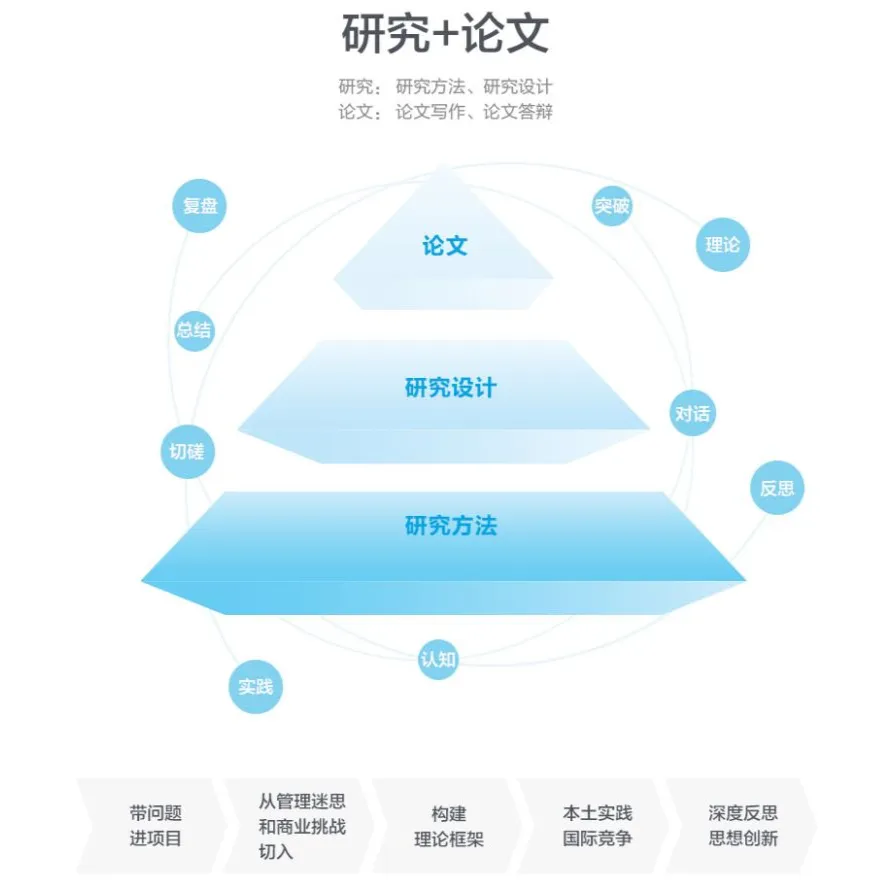

企业家学者项目(DBA)整合全球优质教育资源,打造极具前沿性和系统性课程,在框架模块、聚焦模块、专题研究+实践课堂这三大核心课程中,涵盖2大金融主题与4大微观主题,探索6大宏观方向,定制化行业专题,走访行业内领军企业。孙伊萍同学正是在理论与实践的碰撞中,收获了应对新商业文明下新问题与新挑战的能力。“理解 - 判断 - 实践 - 引领”的DBA学习之旅,让她在企业家学者项目中历经了新商业文明的一次次洗礼,完成了跨越式的思想“突围”。

本次论文答辩,来自长江商学院和新加坡管理大学(SMU)的教授们共同见证了孙伊萍同学的学术成果。

Xuesong GENG

Associate Professor of Strategic Management, SMU

Jianwen LIAO

Professor of Managerial Practice, Strategy, Innovation and Entrepreneurship,CKGSB

Xia CHEN

Lee Kong Chian Professor of Accounting,SMU

孙伊萍 | 中国国有企业ESG评价指标体系构建一一基于企业综合价值论视角的分析

孙伊萍同学答辩中

▇ 论文摘要:

本文探索ESG评价体系对中国国有企业的适用性。作者将ESG 评价体系和中国国有企业综合价值相结合,提出中国国有企业缺乏自己的评价体系,建立中国国有企业ESG 体系有利于推动中国国有企业可量化指标的披露,客观的展现中国国有企业ESG 的综合绩效,帮助企业提升其综合价值。

本文深入研究了现行的ESG评价体系,发现国际主流评价体系在国内企业应用上存在诸多问题。一是评级机构对具体评估方法和假设的基准披露不够透明,评估过程的标淮化程度不够,不同评级机构对同一家公司产生不同的评级结果。二是国际ESG评价体系缺少本土化指标,中央政策的关联性较低,没有兼顾中国国有企业特点,并未将国家对企业ESG的明确硬性要求融入进去,如为双碳目标、乡村振兴及共同富裕等。

为了建立中国国有企业ESG体系,我们将非国有企业作为本研究的参考,假设建立的模型将主要作用于对中国国有企业的评价,利用来自金蜜蜂企业社会责任报告数据库的数据,对中国国有企业和非国有企业社会责任报告或环境、社会及公司治理报告进行文本分析,推导出若干个可能对中国国有企业和非国有企业ESG评价存在较大影响的影响因子,分析发现中国国有企业和非国有企业对ESG关注因素存在差异性,且关注的差异性导致企业绩效存在差异性。因此本研究认为,作为和西方采取不同制度下的国有企业,理应有更契合的模型,来反映特定的指标组合对其整体经营绩效的相关性。

最后,将部分结果与中国国有企业和非国有企业企业家们进行访谈,通过实证检验的方式探寻佐证前文筛选出的ESG关注因素是否是中国国有企业和非国有关注的重点,最终确定影响中国国有企业ESG绩效的主要因子,基于此构建中国国有企业ESG评价体系的评价体系,并运用到中国国有企业ESG管理与实践的落地应用之中。

▇ ABSTRACT:

The paper explores the applicability of ESG evaluation system to Chinese state-owned enterprises. Combining the ESG evaluation system with the comprehensive value of Chinese state-owned enterprises, the author points out that Chinese state-owned enterprises lack their own evaluation system, and establishing the ESG system of Chinese state-owned enterprises is conducive to promoting the disclosure of quantifiable indicators of Chinese state-owned enterprises, objectively demonstrating the comprehensive performance of Chinese state-owned enterprises ESG, and helping enterprises to improve their comprehensive value.

孙伊萍同学在长江DBA课堂上做分享

The paper deeply studies the current ESG evaluation system and finds that there are many problems in the application of the international mainstream evaluation system in domestic enterprises. First, the rating agencies are not transparent enough to disclose the specific evaluation methods and assumptions of the benchmark, the evaluation process is not standardized enough, and different rating agencies produce different rating results for the same company. Second, the international ESG evaluation system lacks local indicators, the relevance of central policies is low, does not consider the characteristics of Chinese state-owned enterprises, and does not incorporate the explicit and mandatory requirements of the state for enterprise ESG, such as the "dual carbon" goal, rural revitalization, and common prosperity.

In order to establish the ESG system of Chinese state-owned enterprises, we take non-state-owned enterprises as the reference of this study. It is assumed that the model established will mainly be used for the evaluation of Chinese state-owned enterprises. Using the data from the Golden Bee corporate social responsibility reporting database, we will conduct textual analysis of Chinese state-owned enterprises and non-state-owned enterprises' social responsibility reports or environmental, social, and corporate governance reports. This paper deduces several influence factors that may have a great impact on ESG evaluation of Chinese state-owned enterprises and non-state-owned enterprises, and finds that there are differences in ESG concern factors between Chinese state-owned enterprises and non-state-owned enterprises, and the differences in concern lead to differences in corporate performance. Therefore, this study believes that as state-owned enterprises with different systems from those in the West, there should be a more suitable model to reflect the correlation of specific indicator combinations to their overall business performance.

Finally, part of the results is interviewed with entrepreneurs of Chinese state-owned enterprises and non-state-owned enterprises to find out whether the ESG concern factors selected above are the focus of attention of Chinese state-owned enterprises and non-state-owned enterprises through empirical test, and finally determine the main factors affecting ESG performance of Chinese state-owned enterprises. Based on this, the evaluation system of ESG evaluation system of Chinese state-owned enterprises is constructed and applied to the implementation and application of ESG management and practice of Chinese state-owned enterprises.

合影

论文答辩圆满结束,但作为终身学习者,这是孙伊萍同学的又一个起点。未来,她将带着对中西方管理学理论的认知与思考,继续践行新商业文明;用独到的洞见不断为中国经济注入新动力,引领行业的发展方向。